Comment by Jaromír Šindel, Chief Economist of the CBA: The January slowdown in consumer price growth to 1.6% (mainly due to fiscal intervention in regulated energy prices) was accompanied by a discussion of a possible slight reduction in the CNB interest rate in order to fine-tune the recent interest rate cycle. However, persistently higher momentum in core inflation has left its interest rate unchanged, and risks associated with service prices and fiscal policy leave all options open for the central bank to move its interest rate. This is also true in light of the central bank's new forecast outlook, which admittedly encourages a marginal short-term interest rate cut before rising to 4% as early as the end of this year. With its decision and the reiteration of both inflationary and disinflationary risks, the central bank has tempered the dovish expectations of some market participants and the outlook for a 3.5% rate still seems likely. The key is the reiteration of the thesis of the sustainability of a return to the inflation target through softer core inflation.

Loans and deposits

Comment by Jaromír Šindel, Chief Economist of the CBA: The central bank did not surprise by unanimously leaving interest rates unchanged, i.e. with the two-week repo rate at 3.50%, for the fifth meeting in a row after a 25bp cut in May. Although the Board did not change its view of the risks and uncertainties surrounding the CNB's November forecast, it did assess the risks to inflation as balanced, given the risks in financial markets and the removal of the renewable energy levy, following November's upside assessment.

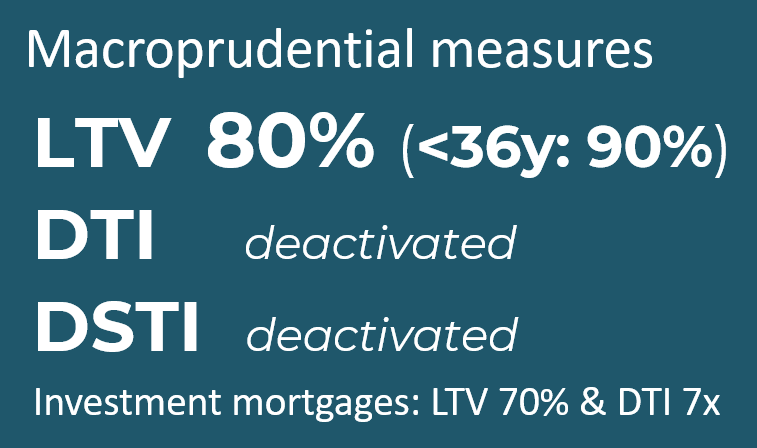

Comment by Jaromír Šindel, Chief Economist of the CBA: The Central Bank, through stricter requirements in the form of recommendations for investment mortgages, has decided to make a modest effort to correct mortgage demand on the real estate market, which remains very tight in terms of prices, mainly due to the supply side - see the drop in building permits.

Commentary by Miroslav Zámečník, Chief Advisor of the Czech Banking Association

Commentary by Miroslav Zámečník, Chief Advisor of the Czech Banking Association

Comment by Jaromír Šindel, Chief Economist at the CBA: While the CNB unsurprisingly left interest rates unchanged with the two-week repo rate at 3.5%, the Board's statement on the monetary policy settings, however, was more surprising in its less hawkish tone, leaving open all possibilities for future monetary policy settings.

Commentary by Jaromír Šindel, Chief Economist of the CBA: Higher-than-expected wage growth will be the main, but not the only, reason for keeping the interest rate at 3.5% at the CNB's September meeting and for the intensification of the hawkish tone in the communication. The latter may indeed indicate a further upward movement in the interest rate, but rather in an unspecified distant horizon. A stronger koruna or tighter monetary policy through the longer end of the yield curve is unlikely to lead the CNB to a dovish mindset.

Commentary by Miroslav Zámečník, Chief Advisor of the Czech Banking Association

Economic commentary by Jaromir Šindel, Chief Economist of the CBA (adjusted for published data on core inflation from the CNB and registered unemployment data, 18:00 8 August)

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

Commentary by Miroslav Zámečník, Chief Advisor of the Czech Banking Association

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

Commentary by Miroslav Zámečník, Chief Advisor of the Czech Banking Association

Commentary by Miroslav Zámečník, Chief Advisor of the Czech Banking Association

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

Commentary by Miroslav Zámečník, Chief Advisor of the Czech Banking Association

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

Commentary by Miroslav Zámečník, Chief Advisor of the Czech Banking Association

Commentary by Miroslav Zámečník, Chief Advisor of the Czech Banking Association

Commentary by Miroslav Zámečník, Chief Advisor of the Czech Banking Association

Commentary by Miroslav Zámečník, Chief Advisor of the Czech Banking Association

Commentary by Miroslav Zámečník, Chief Advisor of the Czech Banking Association

Commentary by Miroslav Zámečník, Chief Advisor of the Czech Banking Association

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Commentary by Miroslav Zámečník, Chief Advisor of the Czech Banking Association

Commentary by Miroslav Zámečník, Chief Advisor of the Czech Banking Association

Commentary by Miroslav Zámečník, Chief Advisor of the Czech Banking Association

Commentary by Miroslav Zámečník, Chief Advisor of the Czech Banking Association

Commentary by Miroslav Zámečník, Chief Advisor of the Czech Banking Association

Interview with Miroslav Zámečník, Chief Advisor of the Czech Banking Association

Commentary by Miroslav Zámečník, Chief Advisor of the Czech Banking Association