Post-Covid revival of economic activity

2.5

%yoy (11-2025)

industrial production

3.4

%yoy (11-2025)

retail without cars

Post-Covid revival of economic activity

(3mma index against January-February 2020)

Comments

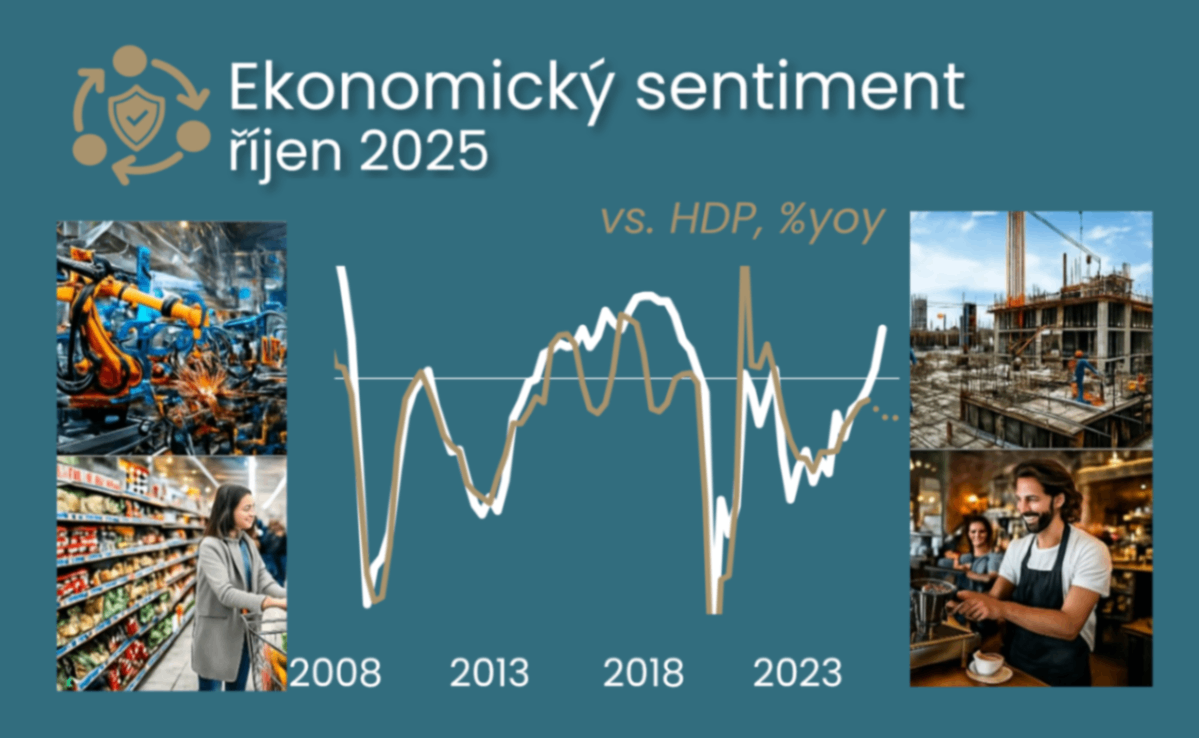

January stability in economic sentiment hides four clearer signals for growth and inflation

Comment by Jaromír Šindel, Chief Economist of the CBA: January show stable economic sentiment, but industry continues to be plagued by weak demand with negative consequences for investment. On the other hand, consumer purchasing plans remain full of optimism, also thanks to both lower price expectations, which are dampened by industry but not services, and better expectations on the labour market, where the service sector, which is lacking more workers, is making a positive contribution. Thus, it looks like continued solid economic growth this year with noticeably lower headline inflation. This combination is likely to shift the discussion at the CNB from rate stability or growth to rate stability or a possible decline, which is, however, not certain given the ongoing "services inflation" and the change in fiscal policy settings.

November brought strong industry and exports, but also stagnation in construction

Comment by Jaromír Šindel, Chief Economist of the CBA: The November data confirm an acceleration in industrial activity, driven by the automotive industry and the recovery of energy-intensive sectors, which pushed annual industrial growth closer to 6%, the highest this year. However, further improvement may be hampered by the December decline in industrial sentiment and export expectations. Construction remains weak, and its high 7% y/y growth reflects the past rather than the current reality of limited public investment and weak building permits issued. The labour market has not yet cooled significantly despite a higher 3.3% selection unemployment rate, confirming continued solid wage growth of around 6% in industry. Quarter-on-quarter GDP growth will thus be underpinned by industrial production in Q4, probably also retail, but construction and the foreign trade surplus will rather take a bite out of it.

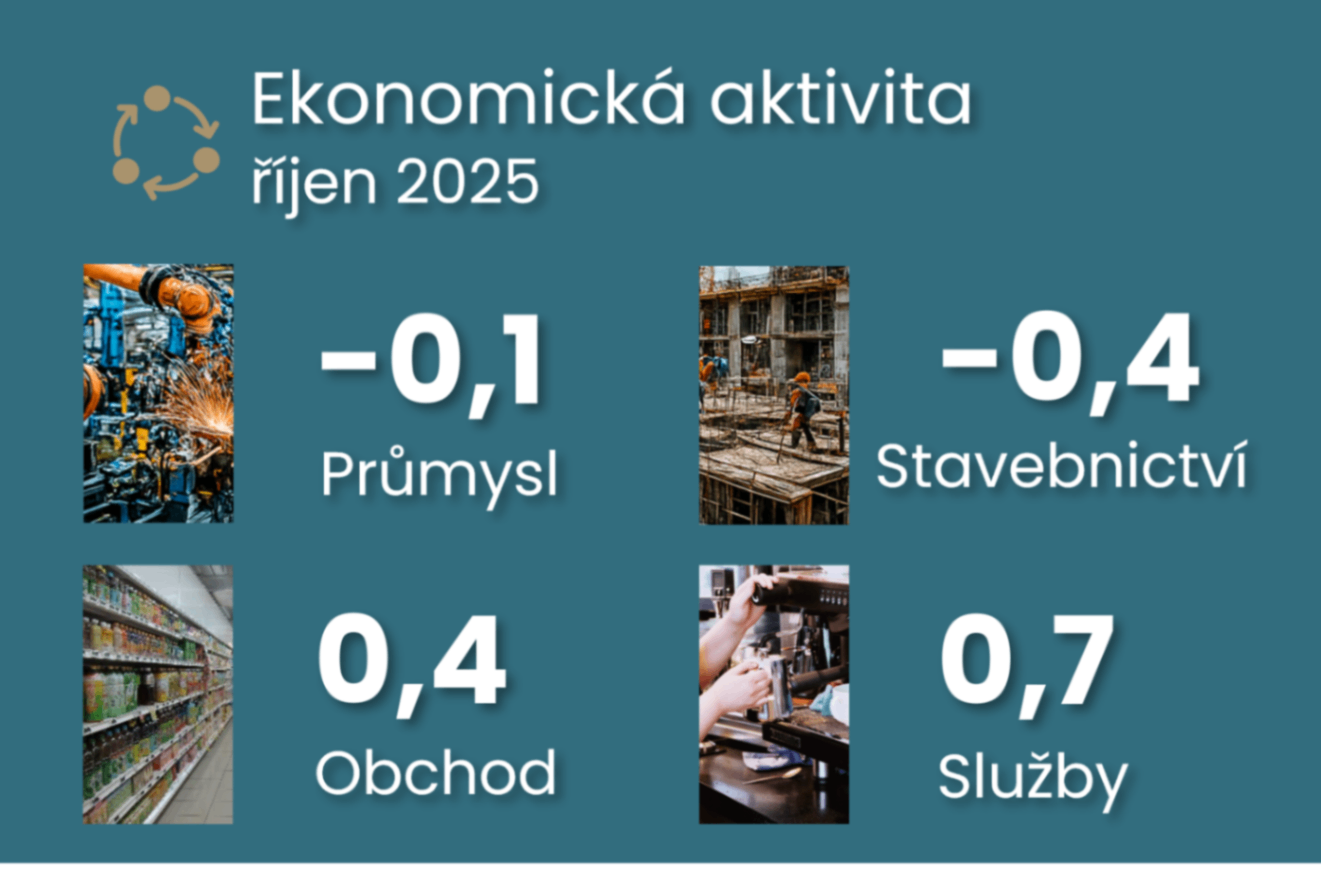

October output disappoints, wages, consumption and historic foreign trade surplus keep driving growth

Comment by Jaromír Šindel, Chief Economist of the CBA: The manufacturing part of the Czech economy remained subdued in October, which supports expectations of weaker GDP growth at the end of this year. However, a post-covetous historical foreign trade surplus is supporting the crown, which, together with a persistently solid wage pace, supported October retail sales. This part of the recent Czech growth model thus remains unchanged, but this is no longer the case for the construction sector, where persistent weakness in building permits and uncertainty over investment financing pose downside risks next year.

Not consumption, but strong September manufacturing helped to boost GDP and October should be no different

Comment by Jaromír Šindel, Chief Economist of the CBA: Retail and services sales disappointed in September despite solid wage growth, which was confirmed by September industrial wages. A gradual but steady rise in unemployment is likely to be in evidence here. Thus, the stronger GDP growth in Q3 was helped by September's industrial production, which complemented the strong construction output of the previous months. Given sentiment, things might not be different in October.

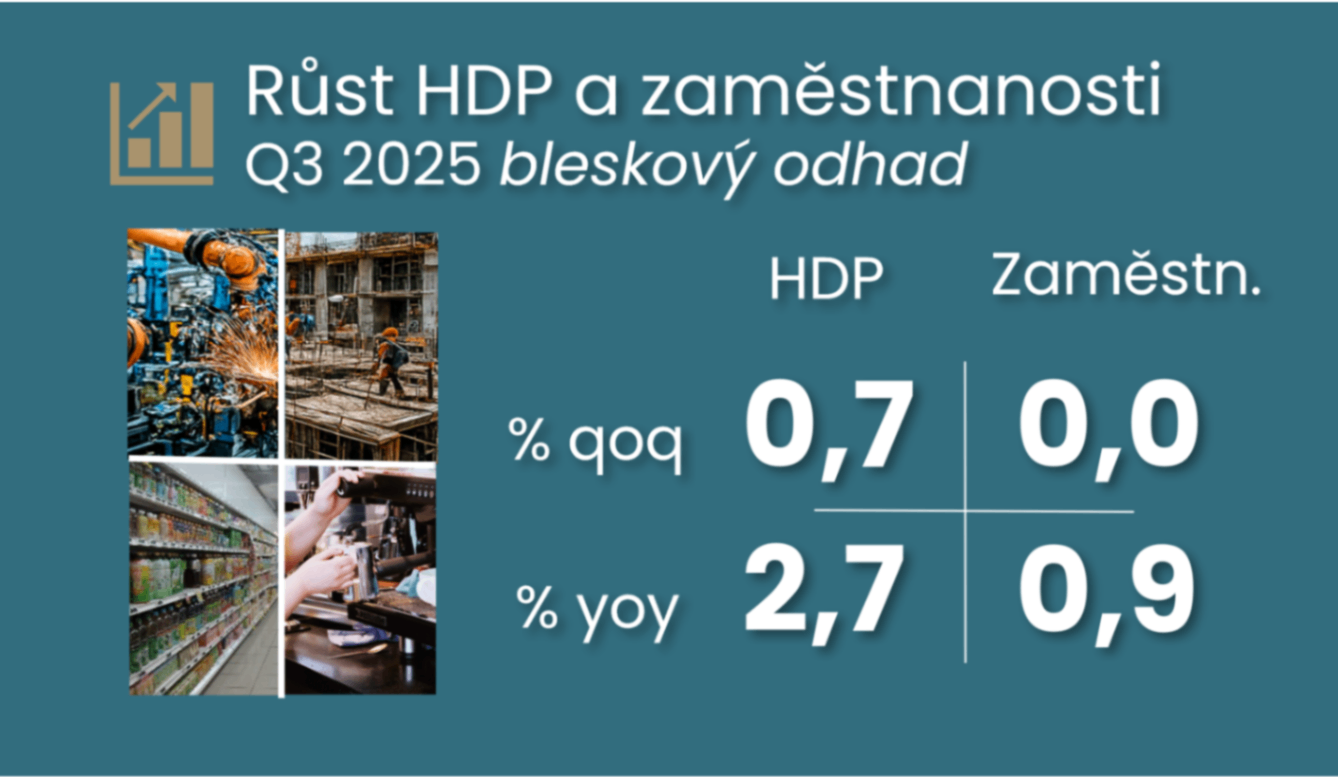

The economy delivered another surprise with productivity growth picking up in Q3.

Comment by Jaromír Šindel, Chief Economist of the CBA: The return to stronger economic growth of 0.7% quarter-on-quarter in Q3 was a surprise, confirming the indications of stronger confidence in September. At the same time, stagnant employment added a welcome return to stronger productivity, which may partially dampen the hawkish impulse of stronger GDP for the CNB. The CNB will most likely leave interest rates unchanged at 3.5%, not only at the November meeting, but GDP details may set a more distinct tone to its communication later in November.

October industrial sentiment awakening with hawkish price signals

Comment by Jaromír Šindel, Chief Economist of the CBA: Stronger sentiment in October suggests a return to stronger GDP growth for the end of this year after a probably slightly worse result in Q3. Higher price expectations may delay the return of core inflation to the target.