October industrial sentiment awakening with hawkish price signals

Comment by Jaromír Šindel, Chief Economist of the CBA: Stronger sentiment in October suggests a return to stronger GDP growth for the end of this year after a probably slightly worse result in Q3. Higher price expectations may delay the return of core inflation to the target.

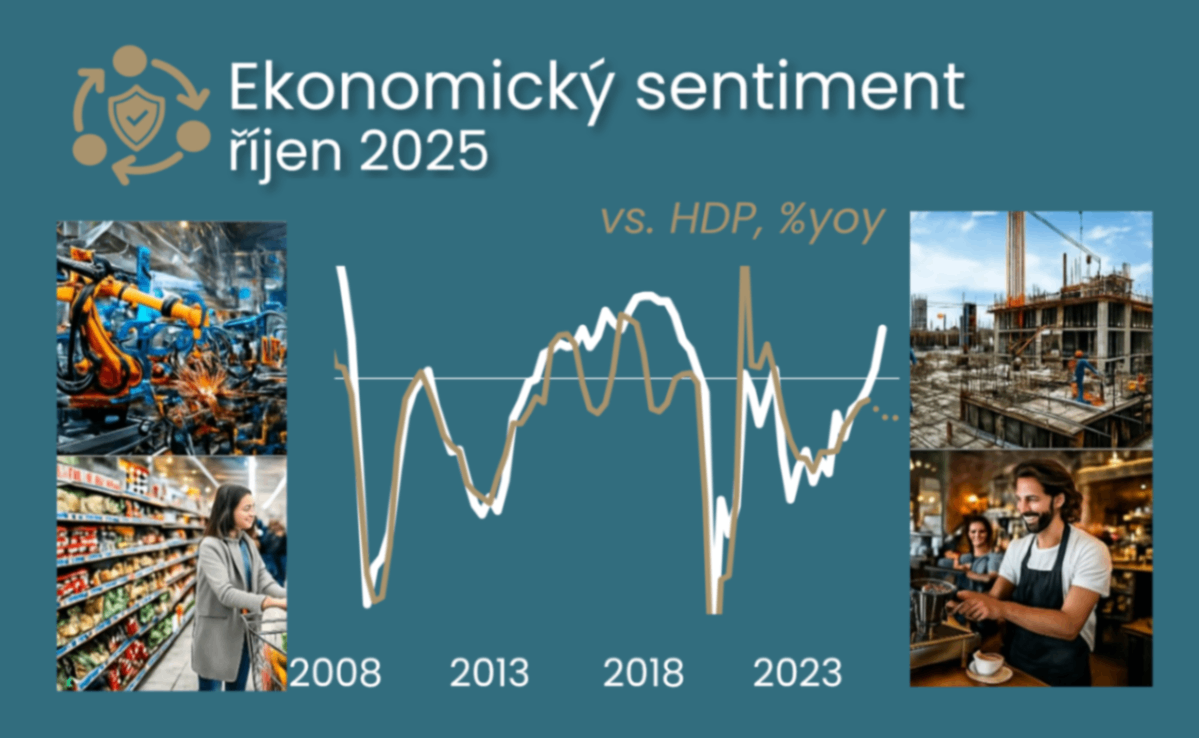

The October sentiment has gained momentum. This was thanks to stronger export expectations in industry, but also thanks to consumers, who, however, did not increase their purchase plans (see the third chart). Could it be a reflection of the election result, i.e. fewer direct consolidation effects on household wallets and the possibility of lower regulated energy prices? From this perspective, October sentiment fits in with the inflationary pre-election market pricing. The CNB's reaction will thus reflect the durability of the recovery in industry sentiment and hence its view of the crown.

However, the prospects for better growth from the monthly sentiment (see chart left) are limited by the quarterly survey, where the problems of still low demand, which limits growth and investment in industry, and the shortage of workers in the construction sector (see chart right) persist.

After a pleasant surprise in September, October's economic sentiment brought a further boost, mainly in the form of stronger industrial confidence. This jumped thanks to better export expectations (see fourth chart) and suggests a possible recovery from almost two and a half years of industrial agony. However, only the next few months will indicate how permanent this change is, as the last four years have seen similarly strong but only temporary improvements.

Sustaining such strong sentiment would signal a more robust economic outlook pointing towards three per cent growth rather than continued concerns about low growth of around two per cent. Unsurprisingly, we also witnessed higher price expectations in October, in services and construction, which may represent an unwelcome signal for core inflation (see the last two charts). On the other hand, consumer price expectations have moderated, probably due to possible short-term disinflationary measures by the government (reduction of regulated energy prices, etc.).

If this signal is realised in the coming months, and industrial sentiment is also sustained, then the CNB could communicate in a more hawkish voice, as the feared appreciation of the koruna in September (see CNB surprised with a less hawkish tone in keeping the interest rate at 3.5%) would be supported by industrial fundamentals.

However, these hawkish appetites may be dampened:

1) only a modest improvement in employment expectations, but one that remains in negative territory and thus still consistent with creeping unemployment growth,

2) as well as persistently weak demand representing a constraint on industrial prospects, not only for production but also for investment. In fact, due to weak demand and orders, industry is still operating around its long-term average capacity utilisation.

Economic activity for July and August suggests a slowdown in third-quarter GDP growth to 0.3% q-o-q, but improved September sentiment keeps the chance of slightly higher growth, but still below the half-percent growth seen in the second quarter. This would result in a slowdown in annual GDP growth to 2.3%-2.4% from 2.6% in the second quarter.

While a return to half-percent quarter-on-quarter GDP growth late this year would slow annual GDP growth below 2% due to the base effect, this year would show solid 2.3% annual growth. This would be about 0.2% points above our forecast and would also open the way for GDP growth closer to 2.5% next year instead of the 2% we expect.

More statistics on economic sentiment at CBA Monitor: Confidence Indicators | CBA Monitor.