Consumer price inflation (inflation)

1.6

% yoy

ytd average CPI in 2026 (to January)

2.5

% yoy

Average CPI in 2025

Consumer price inflation (inflation)

(annual values, % yoy)

Comments

Cheaper electricity has distorted the inflation picture, while core remains strong

Comment by Jaromír Šindel, Chief Economist of the CBA: January's significant slowdown in consumer prices to 1.6% year-on-year mainly reflected the transfer of contributions for renewable energy from household invoices to the state budget. By contrast, core inflation eased slightly to 2.7% y/y from 2.8% at the end of last year. Food prices, which had contributed significantly to the moderation of inflation at the end of last year, rose in January, but less than would have been seasonally consistent. Consumer price growth is expected to reach around 1.7% yoy this year, following a 2.5% rise in 2025, but with core inflation still rising at around 2.5%, this will also require a disinflationary impulse, which is not yet coming from the property market segment, for example. Higher core inflation should keep the CNB interest rate steady at 3.5%, although the market is pricing in a slight cut, as are half of the CBA forecast panelists.

January inflation slowed, but demand pressures did not

Comment by Jaromír Šindel, Chief Economist of the CBA: The significant slowdown in consumer prices to 1.6% year on year in January did not surprise the consensus and mainly reflects lower energy prices, but also food and fuel prices. On the contrary, I expect core inflation to remain at at least 2.8% growth from the end of last year. Although core retail sales corrected with a 0.6% month-on-month decline in December, annualized momentum, along with household plans, remains strong and does not suggest easing demand pressures. Thus, even in light of fiscal plans, interest rate stability appears to be an appropriate stance for the central bank, at least for the coming months. This is inconsistent with interest rate market targeting, but in my view this would require significantly lower core inflation pressures.

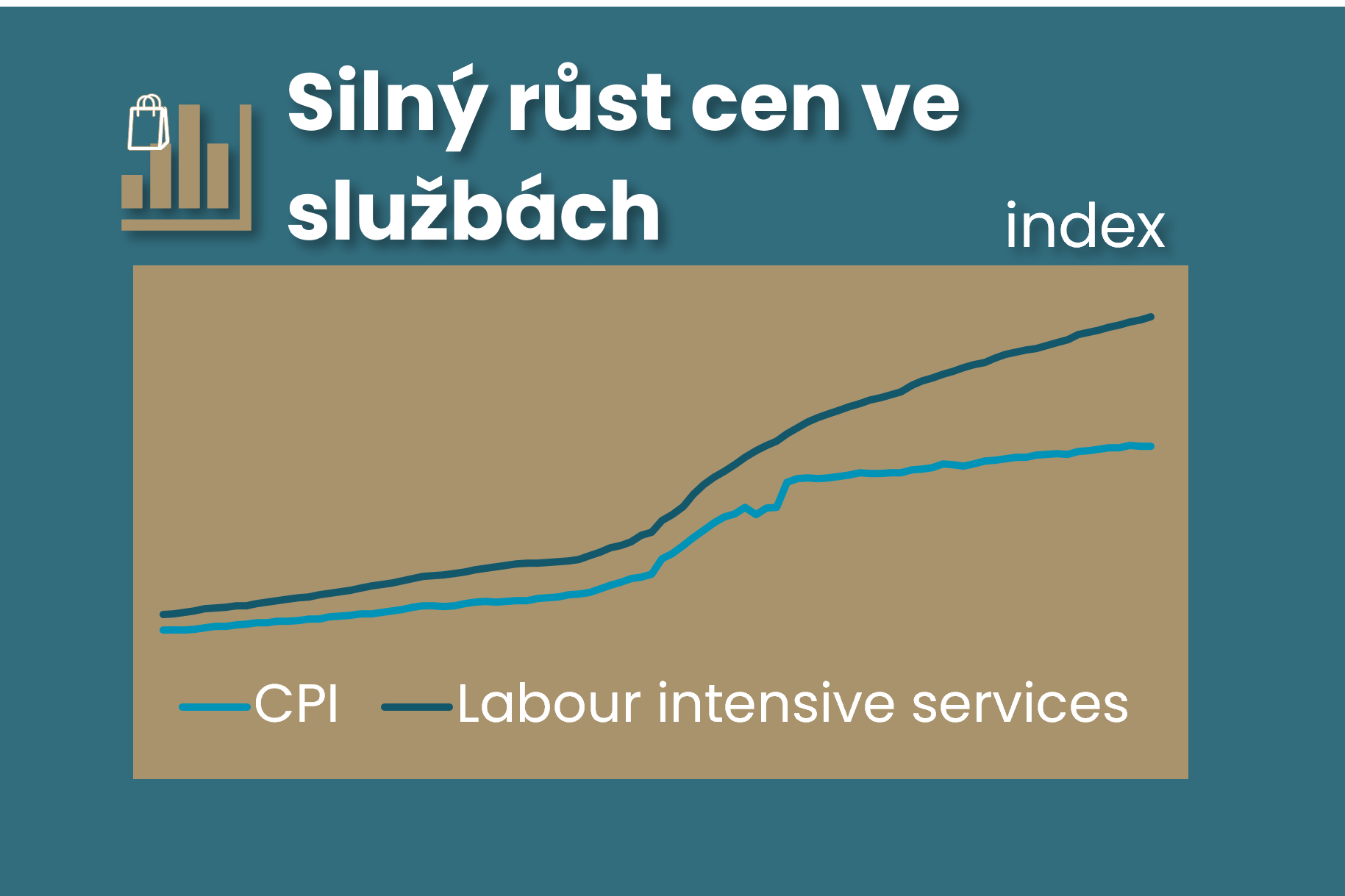

Service prices as a signal for setting (i.e. falling) CNB interest rates

Comment by Jaromír Šindel, Chief Economist of the CBA: The analysis summarizes the government's regulatory steps that will further slow consumer price growth this year, probably well below 2%. What does this mean for the CBA, which seems to be starting to deflate the pigeon balloons, at least more than at the end of last year? Given its earlier communications, where inflation is headed in 2027 should be key, which will also indicate the direction of core inflation in the months ahead. And it is not just the case of still strongly rising services prices that are the focus of this analysis, the first part of the triptych ahead of the CNB's February board meeting.

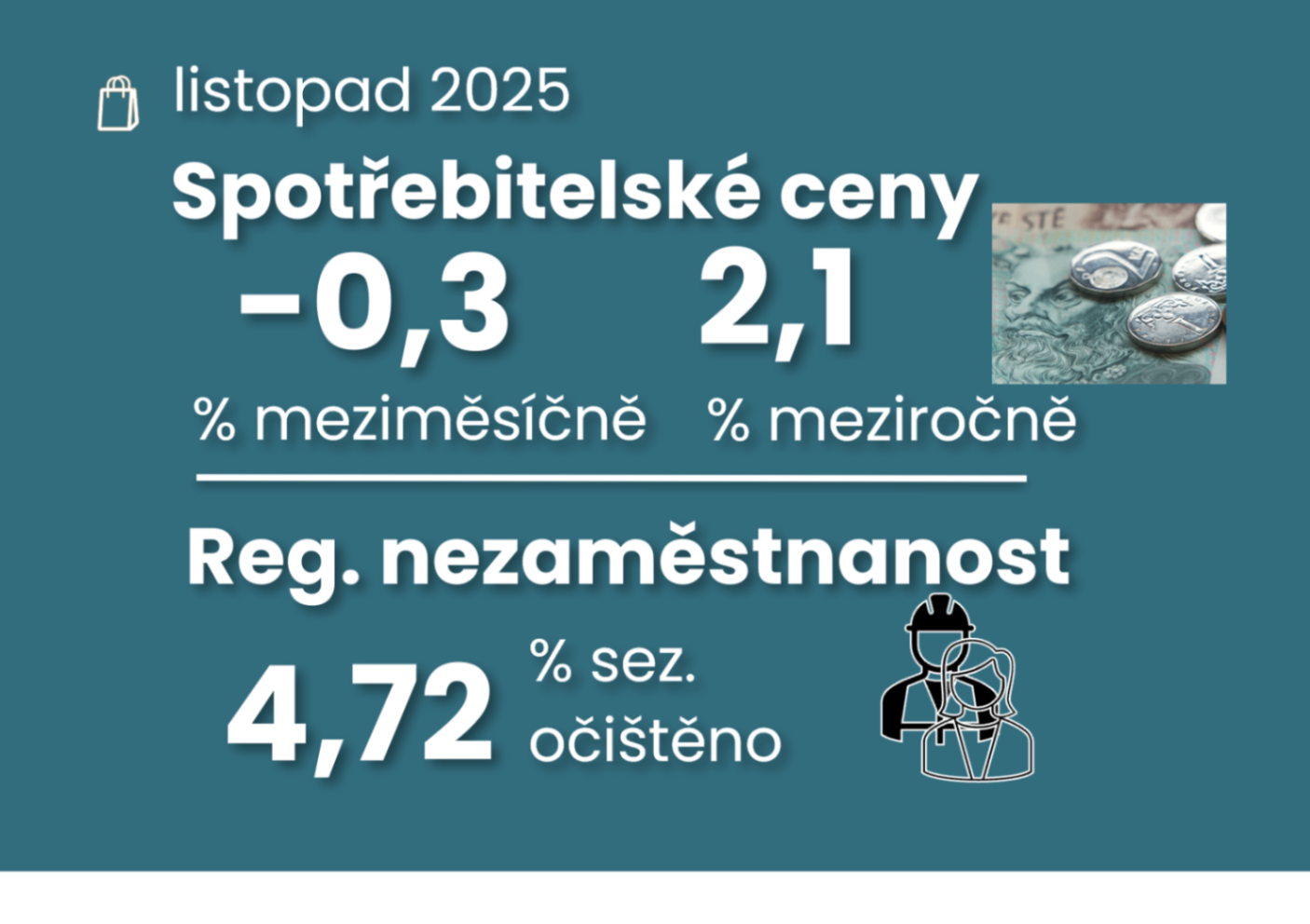

Food and energy prices kept inflation at 2.1% in December

December inflation in the Czech Republic remained at 2.1% year-on-year and was lower than expected by the Czech National Bank and the market. Developments in food and energy prices helped keep headline inflation low, while core inflation is likely to have rebounded to 2.8% after a slowdown in November. However, both figures still missed the CNB's outlook, and this is likely to be repeated this year. This should dampen the upside risk to the central bank's interest rate, but it will remain impatient in waiting to see how fiscal policy affects the economy and inflation through 2027.

The Easing of November consumer inflation to 2.1% is not just about food

Comment by Jaromír Šindel, Chief Economist of the CBA: November consumer price growth did not slow to 2.1% year-on-year only thanks to volatile food prices, which were lower in November. The slowdown in core inflation to 2.6% was probably also due to lower prices for holidays, clothing, household furnishings, as well as lower prices in healthcare and energy. This, and November's move closer to the price inflation target for both headline and core inflation, eases hawkish pressures on the central bank. However, the continued brisk momentum in rent and food and other service prices will not allow the central bank to contemplate an interest rate cut.

Volatile food prices pushed November inflation down to 2.1% amid still strong 7.1% wage growth

Comment by Jaromír Šindel, Chief Economist of the CBA: Consumer price growth slowed to 2.1% yoy in November. The main reason was a deeper decline in food prices, partly due to a slowdown in core inflation from the recent 2.8%. Thus, although inflation surprised positively, food price volatility and still strong rapid wage growth of 7.1% in Q3 will dampen the CNB's willingness to return to rate cuts. And the same reasons dampen the risks to the CBA's outlook for consumer inflation next year at around 2.2%. There remains a significant gap in the recovery in real gross wages between the market and non-market sectors.