Mortgage lending volumes for the whole year

370

billion CZK

Momentum for this year's volume of new mortgages

321

billion CZK

Volume of new mortgages 2025

Mortgage lending volumes for the whole year

Comments

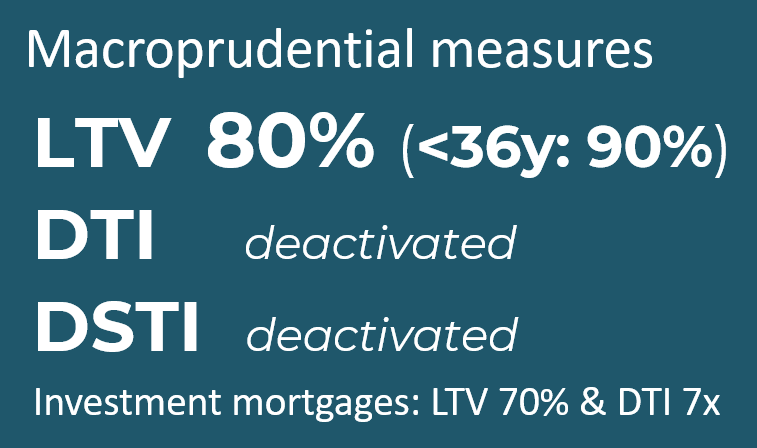

CNB tightens conditions for investment mortgages: 9% impact or necessary redistribution of demand?

Comment by Jaromír Šindel, Chief Economist of the CBA: The Central Bank, through stricter requirements in the form of recommendations for investment mortgages, has decided to make a modest effort to correct mortgage demand on the real estate market, which remains very tight in terms of prices, mainly due to the supply side - see the drop in building permits.

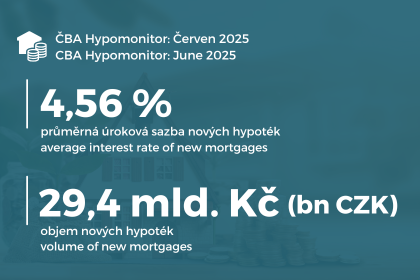

CBA Hypomonitor: Lower June rate to 4.56% brought a recovery in new mortgages

In June 2025, banks and building societies granted new mortgages worth CZK 29.4 billion.

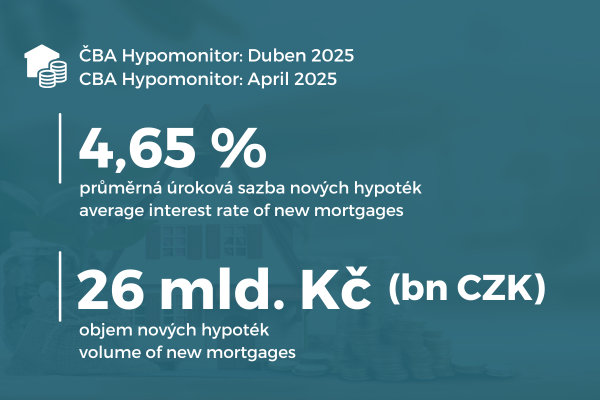

CBA Hypomonitor: April stabilized strong mortgage rates at 4.65%

Despite the slight correction, April continued to see strong volumes of new mortgages supported by another slight decline in the average mortgage rate to 4.65%.

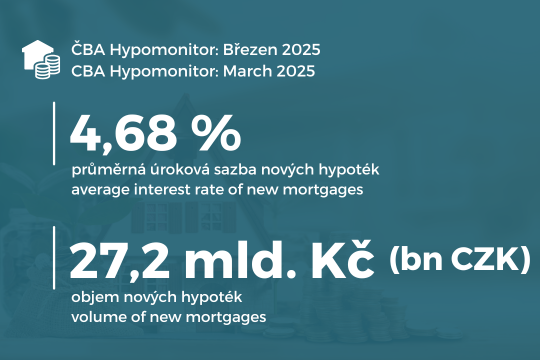

CBA Hypomonitor: Spring mortgage boom with a slight drop in interest rates

March continued to see strong new mortgage volumes supported by another slight fall in the average rate to 4.68%

Seidler: Mortgage market revived faster than expected in the second half of 2023

Interview with Jakub Seidler, Chief Economist of the Czech Banking Association