Unemployment

4.87

% (01-2026)

Share of unemployed persons (registration, sa)

3.20

% (12-2025)

General unemployment rate (trendcycklus)

Unemployment

(%)

Comments

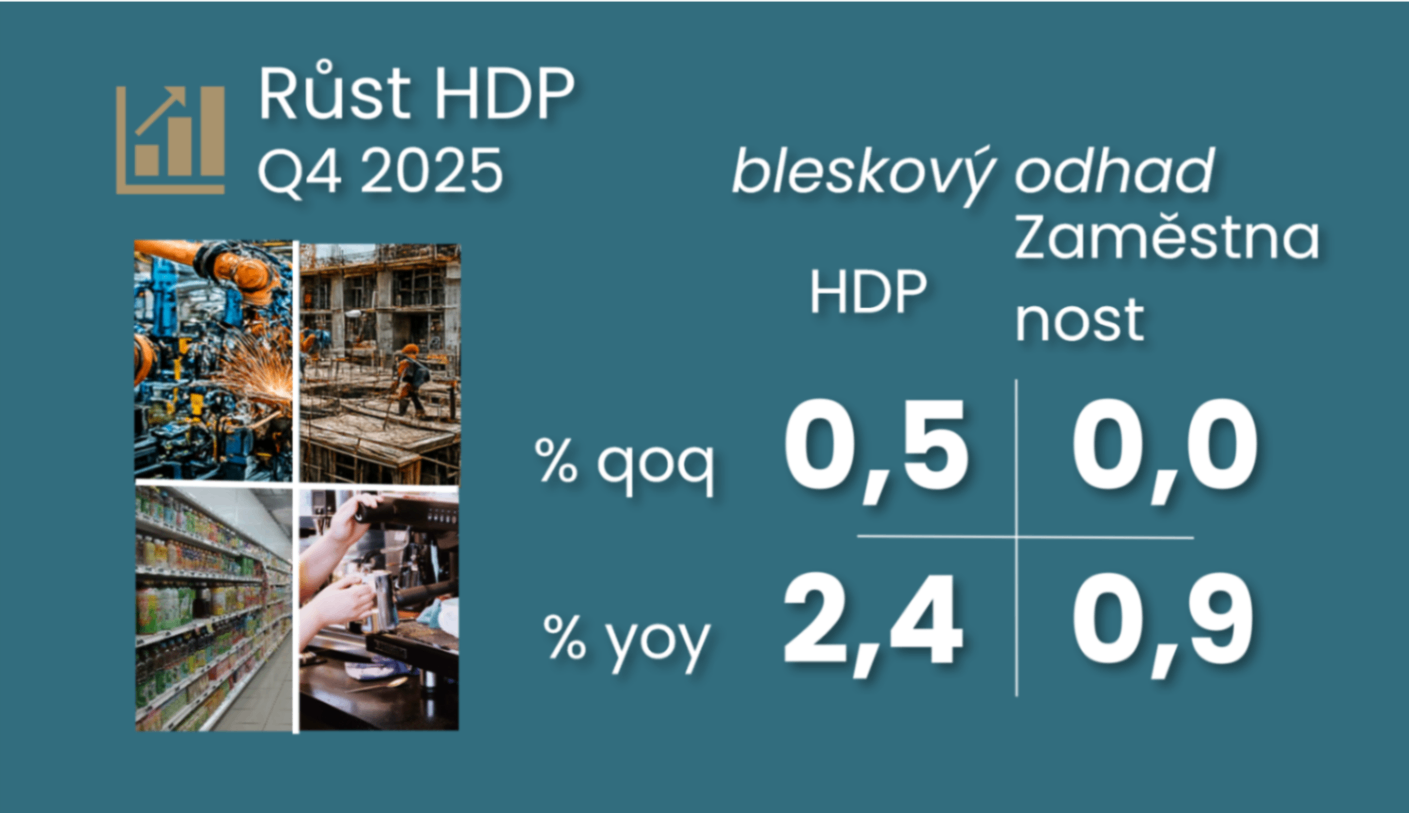

Slight economic slowdown in late 2025 and this year is poised to repeat last year's 2.5% growth

Comment by Jaromír Šindel, Chief Economist of the CBA: Economic growth slowed down at the end of last year, but still achieved solid 0.5% quarter-on-quarter GDP growth.The structure of growth has not changed significantly - consumption is dominant, which is probably not true of investment. This is in line with the latest sentiment data. A more positive sign is improving productivity. The outlook for this year is a repeat of last year's 2.5% growth, thanks to a better outlook for real wage growth and a change in fiscal policy. Conversely, weaker external demand, even given industrial sentiment, is likely to be a drag on stronger economic growth.

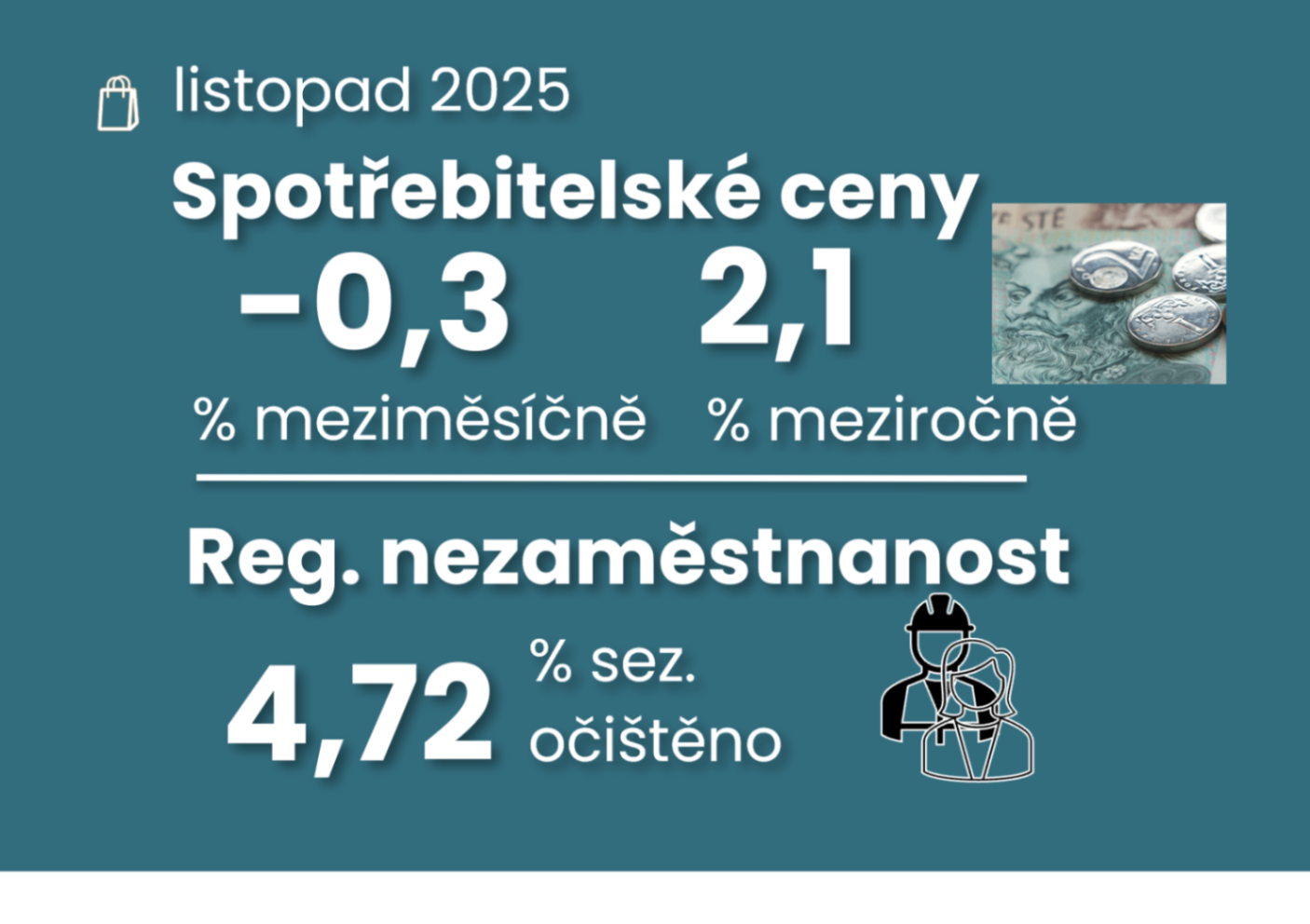

The Easing of November consumer inflation to 2.1% is not just about food

Comment by Jaromír Šindel, Chief Economist of the CBA: November consumer price growth did not slow to 2.1% year-on-year only thanks to volatile food prices, which were lower in November. The slowdown in core inflation to 2.6% was probably also due to lower prices for holidays, clothing, household furnishings, as well as lower prices in healthcare and energy. This, and November's move closer to the price inflation target for both headline and core inflation, eases hawkish pressures on the central bank. However, the continued brisk momentum in rent and food and other service prices will not allow the central bank to contemplate an interest rate cut.

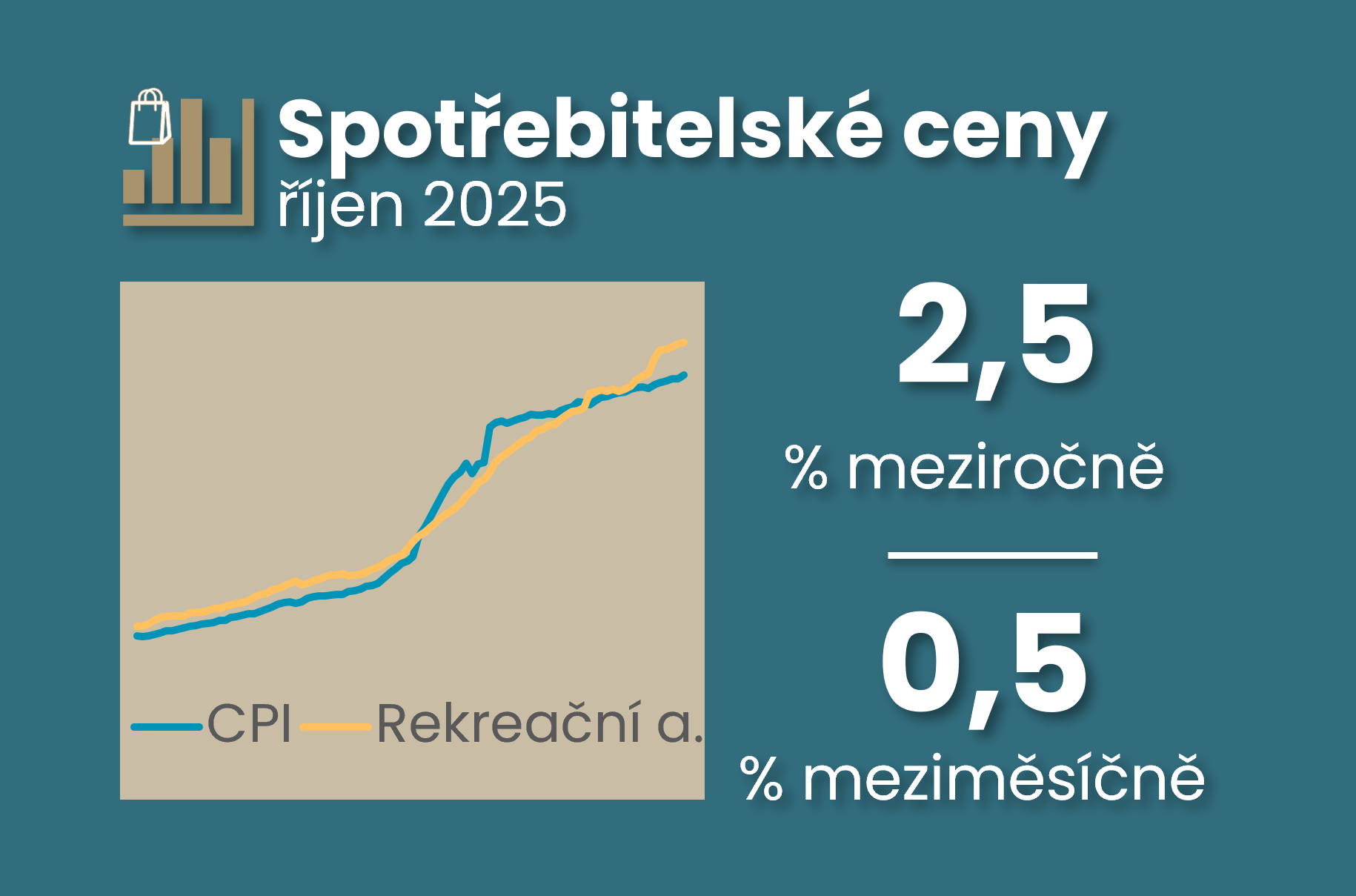

October consumer inflation at 2.5% and continued rise in unemployment keep CNB on tenterhooks

Comment by Jaromír Šindel, Chief Economist of the CBA: October consumer inflation not only confirmed a more pronounced shock from higher food prices, but also showed higher prices of transport services and prices of means of transport as part of core inflation. In the longer term, it is worth noting that imputed rental prices have already caught up with the previous inflation shock, and the same has been true for a few months for holiday prices. Thus, the higher October inflation and unemployment data will not help the central bank or the market resolve its dilemma of the next interest rate move.

July details of softer headline and core inflation look promising, registered unemployment less so

Economic commentary by Jaromir Šindel, Chief Economist of the CBA (adjusted for published data on core inflation from the CNB and registered unemployment data, 18:00 8 August)

Strong June year-on-year consumer price growth masks weaker month-on-month services price growth

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

May confidence in the economy: despite all the setbacks, we're moving on

Economic commentary by Jaromir Šindel, Chief Economist of the CBA