Realised house prices maintained a strong pace in the second quarter

Economic commentary by Jaromír Šindel, Chief Economist of the CBA: I estimate overall growth in realised house prices of 4.2% quarter-on-quarter, which has outpaced wage growth for the sixth quarter in a row.

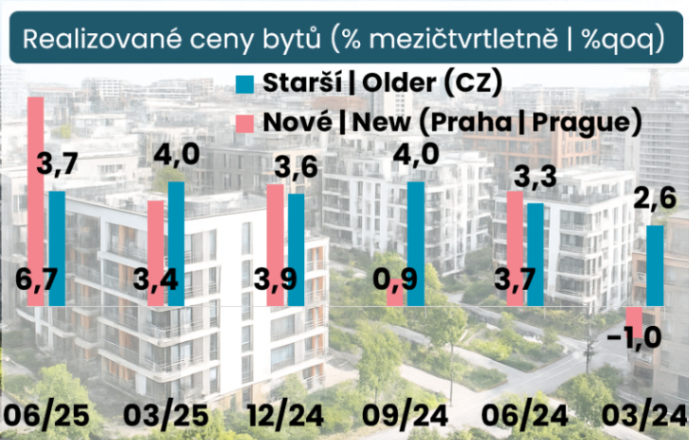

Older flats realized their prices at a slightly slower pace of 3.7% quarter-on-quarter growth in Q2 2025, according to CSO data, while realized prices of new flats in Prague added a strong 6.7%. The strong momentum in realized prices of new flats is expected to ease in Q3 due to lower growth in offer prices, as well as in light of the development of transaction prices for first-time sales in August by Flat Zone. Year-on-year growth in realised house prices was around 16% in the second quarter, slightly stronger than in the previous quarter (see dashboard below). These dynamics are exacerbating price indicators of housing affordability and imply continued strong growth in imputed rents within consumer prices. A CNB interest rate cut thus seems unlikely for the rest of the year. Their future direction will be determined by whether the stronger wage growth of the second quarter persists in the economy and continues to outpace productivity growth (see discussion here).

According to the CZSO data, realised prices of older flats in the Czech Republic rose by 3.7% quarter-on-quarter in the second quarter of 2025. Although this is a slight slowdown after the previous 4% increase, it corresponds to the development in the previous four quarters. Thus, their pace has now exceeded the average quarterly growth of 2.9% recorded since the end of 2019 for five quarters in a row. Regionally, prices of older apartments in Prague slowed to 2.2% after 3.5% (vs. average growth of 2.3%), while outside Prague they stabilised at 4.2% (vs. average growth of 3.1%).

Prices of new apartments, the first sales, in Prague jumped 6.7% q-o-q in Q2, following a nearly 8% q-o-q jump in the previous quarter, Q1, in the supply of apartments in Prague. Offered prices of flats in Prague slowed their increase to 1.5% in Q2, which may push realized growth of new flats lower in Q3.

This is also the direction of Flat Zone's data on transaction prices of new flats on first sale for July and August. These corrected their previous gains in July, especially in the regions, and showed a slight decline in August in both Prague and the regions (see last figure).

In the Czech Republic, prices of older dwellings then rose by 16.3% y-o-y, reaching 1.9 times the pre-pandemic level in Q4 2019 and 3.3 times the level at the end of 2013. These ratios reached 1.7 and 2.7 times in Prague in the second quarter and 1.9 and 3.5 times in the rest of the country.

In the past year, 2024, the average change in realised prices of older dwellings in the country was 7.8% year-on-year (after -3.2% in the previous year), of which 8.4% in Prague (after -2.6%) and 7.7% in the rest of the country (after -3.4%).

More charts on the CBA Monitor: Real Estate Prices

Read more on the real estate prices methodology here: "Complete" real estate prices according to the CZSO show for Q1-2025 a more moderate increase than housing prices + insight and challenge to the methodological kitchen.