Softer September inflation gives CNB room to wait for government formation

Comment by Jaromír Šindel, Chief Economist of the CBA: Lower food prices, a seasonal decline in holiday prices and a slight catch-up in education prices contributed to September's more moderate consumer price growth of 2.3%, which, however, reminds us of possible price catch-up in other segments next year as well (see Chart 4).

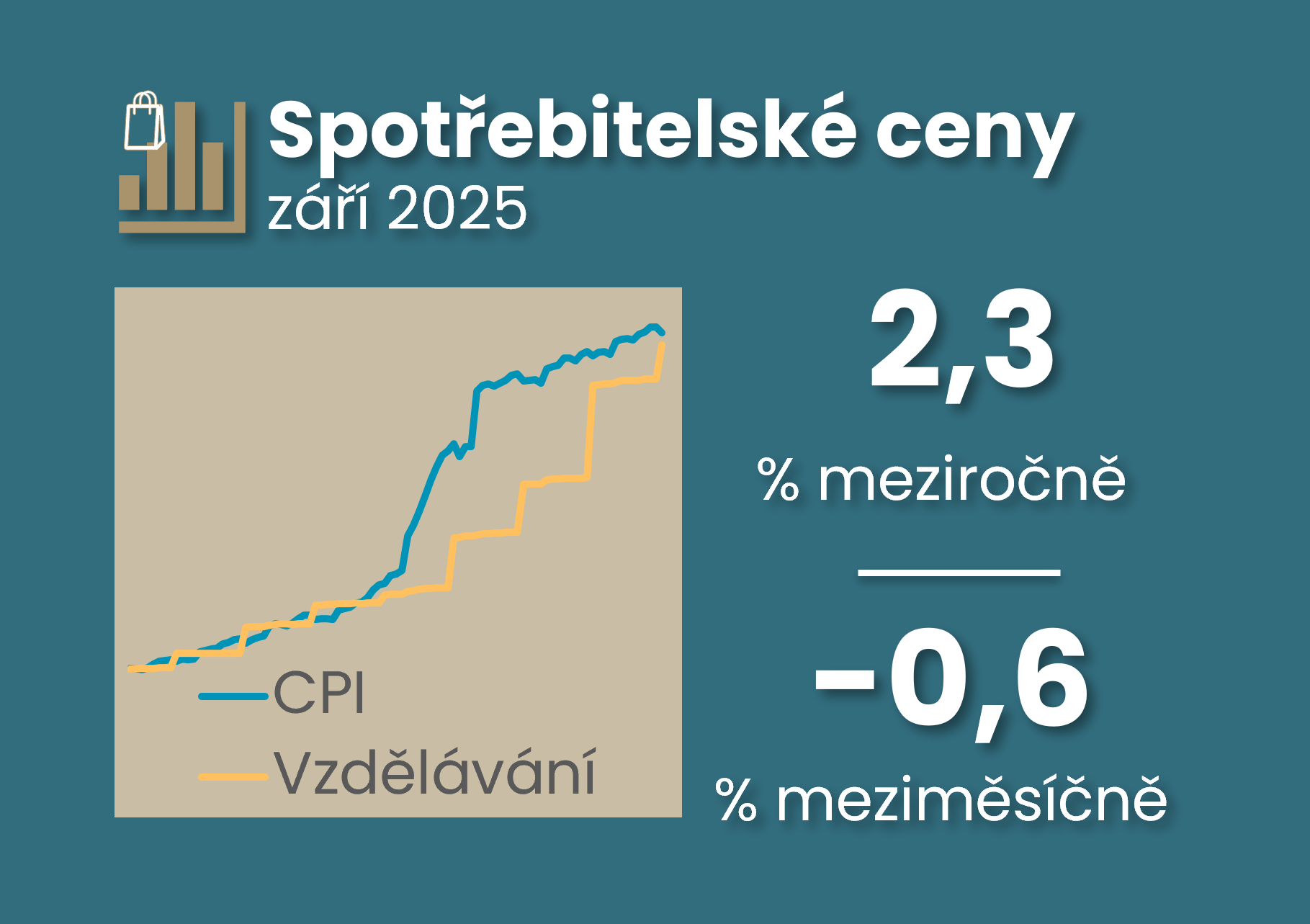

The CZSO confirmed a slowdown in September consumer price growth to 2.3%, which, when it published its flash estimate, undercut market expectations and those of the CNB, which had expected a slight acceleration to 2.6% from 2.5% in August. At first glance, core inflation growth looks around 2.7-2.8% after August's 2.8%, which would be a slightly positive result from the CNB's perspective at the lower reading, but it will confirm this after 1pm.

The 0.6% month-on-month decline in consumer prices in September contributed to the slowdown. This was mainly due to

- seasonal decline in holiday prices, albeit slightly milder than usual

- decline in food prices, likely offsetting August's more modest decline

- energy and transport prices (see Charts 6)

- a modest catch-up in education prices, which was milder than last year but remained unfinished

- stabilization of imputed rents around the usual pace over the past decade, after stronger growth at the beginning of the year

Implications for next year? Reverberations of price catch-up in some segments can be expected next year, probably moderate in education next September, but with likely upward pressure in postal and transportation services (see Chart 4). The CBA forecast expects consumer inflation to rise by 2.5% y/y this year followed by 2.2% in 2026.

Apart from the dynamics of core inflation, the central bank's next steps will be influenced by post-election developments - i.e. how quickly the government is formed and how it sets budget and energy policies. The key will be:

- whether a budget can be passed without a budget provision that would dampen the fiscal impulse at the start of the year

- when and how the government will proceed to regulate energy prices differently, or with what impact on the budget

- how ETS2 will affect electricity prices and emission allowances (the CNB conservatively estimates that ETS2, at an inflation-adjusted price of EUR 57 per tonne of CO2, will raise consumer price growth by 0.6% points, including a currency-relevant secondary impact of 0.15% points, which would slightly push the CNB rate up by 0.1% points).

Softer September inflation gives CNB room to wait for government formation

The decline in food prices probably offset August's more modest decline

Reverberations of price catch-up in some segments can be expected next year, probably moderate next September in services, but probably also set in postal and transportation services

The segments with the largest downward deviations from normal seasonality were food, clothing and recreation (as last year) and health.

Energy and transport prices also contributed to lower prices in September